Modern payment systems directly integrate to point of sale and deliver a robust payment experience for merchants and customers. With them, merchants are connected to a total payment ecosystem, from merchant services to remote terminal solutions to hardware procurement. There are many benefits that these systems offer such as the following:

Allow Flexibility of Payments

For a business to stay relevant among its customer base, it has to meet and exceed the expectations of their customers. Many businesses focus on having the ability to accept all forms and methods of payments to maximise their sales. Fortunately, a modern payment system from Central POS helps any business achieve this by giving them the ability to accept all major credit cards, contactless transactions, EMV chip, and PIN debit. Having universal payment acceptance will keep customers happy, return for more purchases, and show the business’ drive to stay on top of payment trends.

Ensure Business Get Paid Faster

Updated technology and faster internet connections speed up electronic transactions on which modern payment systems run. Additionally, the systems let merchants add on a next day funding option. They allow merchants to increase their cash flow by getting paid within 24 hours after batching.

Ensure Secure Payment and POS Integration

While integrated payments are becoming more common, a lot of merchants still use non-integrated systems. Aside from being more secure than stand-alone payment technology, integrate saves merchants both money and time by pushing the transaction to the payment terminal rather than entering the amount manually. Also, with payment integration, invoices are automatically updated when payment is tendered, ensuring more accurate accounting.

Effectively Manage Remote Terminal

Advancement payment systems provide great terminal management software that helps merchants manage every aspect of their payment devices from their office. By having a real-time list of terminal inventory online, merchants can meet compliance standards and keep track of device transactions across retail locations. Merchants that have remote terminal solutions can detect and report payment device problems for maximum uptime of their fleet.

Reduce Operational Costs

Contemporary payment systems are looking to lower a merchant’s operational costs. Integrated payments and advanced terminal management make it possible for the systems to communicate seamlessly with several payment devices and work stations at once. With shared payment device management, cashiers can push a transaction from any workstations to a shared payment device. This flow will help merchants effectively save money on the cost of buying new terminals.

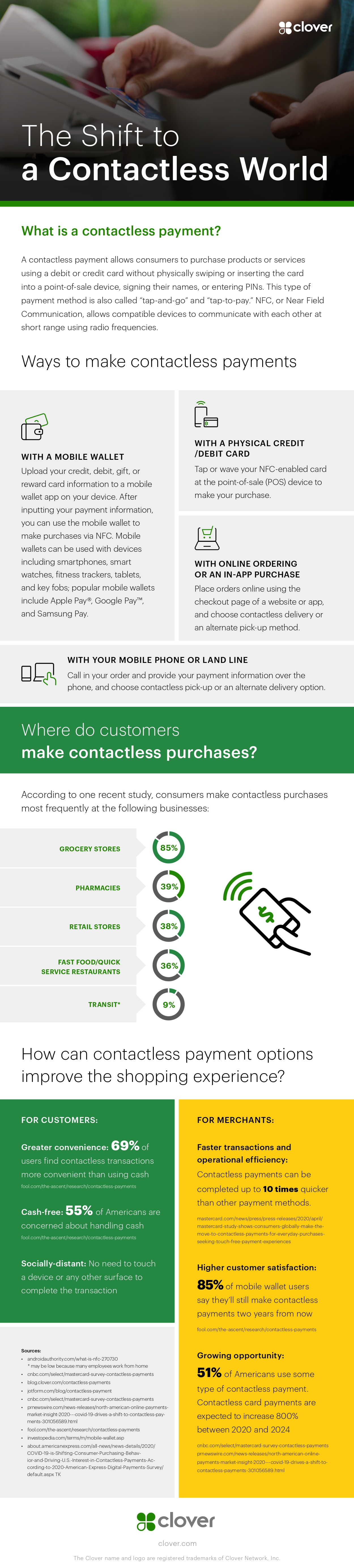

Infographic created by Clover Network, a credit card processing company